Last edited on July 7, 2024

How are you going to deal with money transfers to Spain? If only there was a moving company for this kind of move, right? Wait, there is! In the first part of this post, I’ll share our own experience with Wise, which has been quite helpful over the years helping me moving money the legal way. Next, I’ll give you my impressios about banking in Spain, and tell you the story of how we opened our first bank account just with a NIE. Finally, a bit of comparison between banking in the USA and in Europe. I wish you a profitable read!

Above: two of the main banks in Spain. BBVA on the left and Santander on the right, at Fuengirola.

Table of Contents

Money transfers to Spain

Before moving to Spain, I opened a Wise account. Long before, actually; I have mine since 2015, when I lived in Estonia. Wise, which was founded as Transferwise, was already very famous there back then; after all, it is an Estonian company. I received salary in dollars but needed euros and sometimes reais (Brazilian currency) so I frequently had to exchange currency through a bank. That was expensive; Wise helped me tremendously by cutting that cost. I kept the account, that is free, as up to today I sometimes send or bring money from Brazil.

While in the USA, preparing to move back to Europe, my Wise account was once again very helpful, because we wanted to convert our savings to Euro (to buy a house in Spain). The Wise account was our “money bridge” in a way. We transferred dollars to the account, exchanged to Euro and transferred from there to Hubby’s conventional bank account in Europe at a fraction of what we would have spent doing it through banks. And we did it from home.

We didn’t keep the money in Wise because back then they charged to keep funds above 30K; nowadays, they actually pay interest for money on the account – just getting better!

Moreover, having an account in euros and its corresponding bankcard would have made it easier to wait to have an account in a conventional bank in Spain. I say “would have made it easier” because we didn’t actually have Wise’s card; we could have had it, but because we used Wise more as a way to transfer funds between countries, we didn’t anticipate we would have use for the card. Silly mistake.

We counted on Hubby’s Estonian bank card, that he forgot to bring in the luggage… Having a second bank card connected to an account in euros would have been great. When we arrived in Spain, staying in short term rentals, we didn’t have a proper address to order a card so we stayed without it for long. But now Wise does offer a digital card for free! 😉

Hubby has his only business account with Wise, because his company receives and pays in both euros and dollars and there is nothing more convenient or cheaper for us. And now he has a Wise card. For all the easy that being a Wise client has brought us on our years living abroad, I wholeheartedly recommend that you consider opening an account with Wise before making the move to Spain, especially if you are coming from a country whose currency is not the Euro.

Wise’s account is free and the exchange is much cheaper than through a regular international card. Even better if instead of packing the card with the move you actually bring it with you. And if you use any of our Wise links to open an account, you’ll be also helping us keep this site up!

In Spain: Brick and mortar bank

You can keep your Wise account, which is in any way free of cost. It will continue to be quite helpful until you open an account in a Spanish bank and even after, to exchange between Euro and your original currency; plus, it is a very fast way of payment either internationally or in the same country.

In Spain, though, it is convenient to also have an account in a brick and mortar bank, for 3 main reasons:

- Utilities: all your future utilities bills will be tied to this new Spanish account. By default, they are in automatic debt. Phone, power and water companies, as far as I know, don’t send paper bills. They send e-mails showing the comsumption of the previous month and telling how much will be debted from your account on the next payment.

- Cashier’s check: If you want to buy a property in Spain it is also useful to have a bank account in Spain, as the cashier’s check (that we explain in the post about buying property) can be made from your bank account. But it is not essential; some banks offer to give you the cashier’s check as long as you transfer the pertinent amount to then. This service, though, tends to be charged and by large – think in terms of hundreds of euros. Some banks also charge for this service from their clients (but less) and some banks don’t charge at all for this check for their costumers. How much they charge for the cashier’s check is a good thing to ask around when considering where to open an account, if you intend to buy a place.

- Salary: if you are coming as an employee of a company established in Spain, you probably need a bank account to receive your salary. But in this situation your process may be simpler, as your employer probably has your residence process advanced by the time you arrive in Spain, or may understand your transitional situation and keep paying you either in your original country or through Wise.

Banking in Spain for non-residents

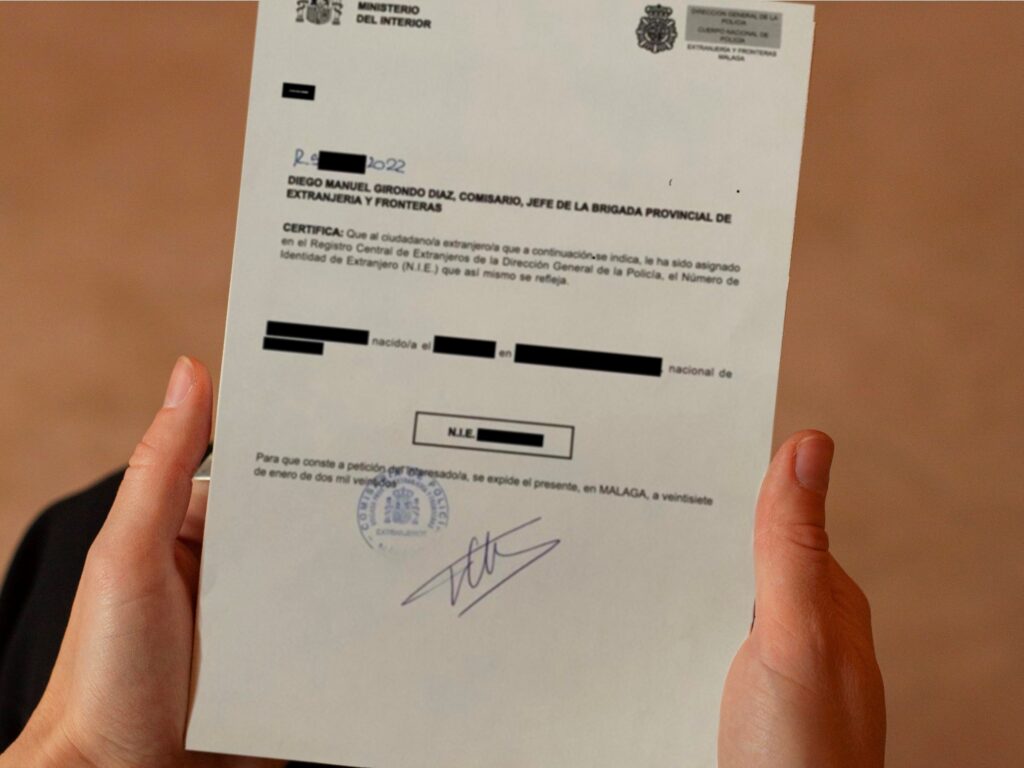

We managed to open our first bank account (Hubby’s) as soon as he had his NIE (I mean the white A4 paper) and, therefore, before becoming a resident. We were in a hurry both because we forgot the bank card and because we thought transferring the money to buy a house would be a lengthy process, so we should better start it soon (it was surprisingly fast, in fact).

How? Well, first we got familiar with the main banks in Spain, asking for recommendations. Some of them are Unicaja, BBVA, Santander and Sabadell. Then we started going to these banks and asking about opening an account. They all liked our question 🙂 and someone would come talk to us. When we explained we weren’t residents, things often changed a bit. Some would say “no” straight away, others would have a long list of extra costs, some were confused.

But we noticed that going to different branches of the same bank would give us different answers or list of requirements. We also noticed that most banks had a bunch of different “products” (namely, bank accounts) charging differently based on small details. It was confusing even for the bank clerks, despite their efforts.

Finally, one agent told us that yes, they would open a bank account for a non-resident, as long as we also hired a home insurance. Hubby informed that we didn’t have a home yet, to which the agent replied that we could already purchase the insurance and it would start only after we bought a place. I was happy to acquiesce, as that would solve our bank account problem, but Hubby was not happy at all. He called it BS (not verbally; Hubby has manners).

He thought the agent was forcing a sale and inventing a non-existing requisite. Hubby asked to see where this requirement was written, and the agent said simply “Nowhere.” As if it was a normal answer. Well, that was our clue: we knew that in this bank – BBVA – it was possible to open an account for a non-resident. We left for another agency of the same bank; asked the same question and got a yes, without any home insurance requirement. They accepted to postpone the need to present the residency documents, and called us in a few months to present them (or else, I think they would close the accounts. We already had the papers and presented them gladly).

Unbelievable. Super Hubby scored! And we opened his bank account with his NIE in the A4 paper and his passport only. The same for me, actually. We bank with BBVA and we are happy with the services and especially with our agency. But notice that banks change a lot what they feel they can or can’t do, so it is a bit of a lottery.

Walk a lot and talk a lot; don’t discard a bank just because one branch makes crazy requests – discard that branch and move on. Also, the branch that demanded we buy the insurance was located in a very touristic area, while the one that didn’t demand it was in less touristic, more residential zone. Perhaps that also plays a role.

A very peculiar bank trickery

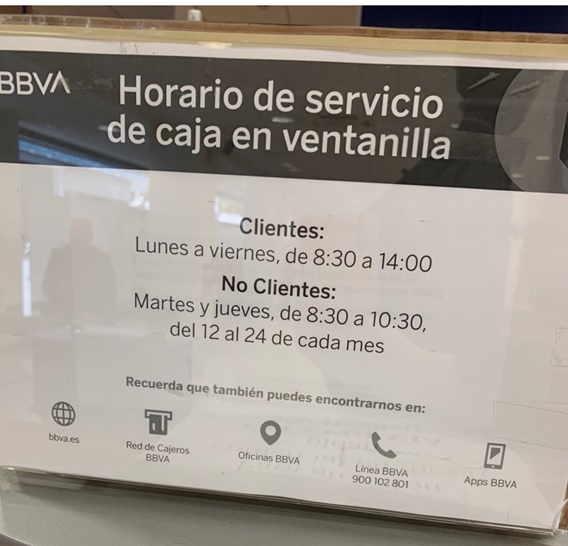

We were seen on the banks without an appointment when we were trying to open an account, but for paying fees, non-clients are seen only in certain hours and days. Before being able to have bank account, before even having a NIE, you need to pay the NIE’s fee on a Spanish bank. At that moment, you are certainly not a client of any bank in Spain, so you try to pay your fee at the nearest agency.

There they say they can’t help you, because non-client’s time is on Tuesdays, and today is Wednesday. Then you try the next bank; there you can’t either, because non-client’s time was only from 8:30 to 10:30, and now it is 11:00. Then the next – ops, they just see non-clients in the first half of the month, today, 25th, it is impossible.

Now, that is a bit irritating, you see? You gotta match with the bank; swipe right or left until you find one that is willing to receive your fee. Realistically, take pictures of the non-clients times of the banks near you and plan ahead before paying those initial fees (for NIE and TIE). After you become a client, they see you on the regular bank hours, which is something around 9:00 to 14:00, Mondays to Fridays. They can close earlier during summer, though; also, check the national and local holidays to avoid wasting the trip.

What to ask when checking the banks

Fees, fees and more fees. Check if there is a monthly maintenance fee and if there is any fee associated with transactions; also if there is a fee or discount associated with the amount of incoming you will transfer monthly. Check also the (way too many) different account models they have. I do wonder if their goal is to make prospective clients confused, but they have several options of accounts that in the end, do the same thing – hold your money – but charge differently.

If you are planning to buy a place and intend to have a mortgage, ask about the mortgage conditions too; the bank where you open a bank account is the most likely to give you a future loan, as they are the ones in charge of your money and know you the best. If you plan to buy upfront, without mortgage (which in Spanish is called to buy al contado) ask them for the price of the cashier’s check – some banks charge hundreds of euro for this check, even from their clients; others do it for free for their clients.

Differences from banking in the USA

Ok, let’s face it. Banking in the USA is different. If you are coming from elsewhere in Europe or from Brazil, banking in Spain will not bring many surprises; but if you are coming from the USA, be ready to be pampered by a very efficient banking system. 😊

Starting with the best: no paper checks in Europe, except for the cashier’s check to buy a house. Everything you would pay with a check in the USA, in Spain you pay by money transfer, which takes only a few minutes to conclude (sorry Estonians; I know there it is immediate, or so it was before Estonia had to downgrade their bank system to comply with EU banking standards; in Spain it takes long from your perspective).

It is safe, my dear US readers; no chance for the check to get lost in the mailbox. You do get proof of payment in your bank account, so you can prove that you paid what you paid. You can do this transfer from your phone or from a computer and it is very easy. No need to find a pen, no risk of running out of paper checks, no need to request more checks, no risk of writing something wrong, no mail posting, no delay. All you need is the person’s phone number or IBAN and full name, basically. It’s called Bizum, in Spain.

Have you ever read the term IBAN? IBAN is a cute European invention. It stands for International Bank Account Number. Every European bank account is identified by an unique IBAN, which is a code made by two letters followed by up to 30 numbers. The first two letters identify the country where that bank account is from; the numbers encode the bank institution and the account number, plus a mechanism to check if that number makes sense – making it safer!

You can give your IBAN to anyone that asks, as the only thing they can do with that information is to transfer you money. And that’s what an IBAN is used for – you need to ask it in order to transfer money to someone. Wise’s accounts give you a IBAN, of course.

Everything that you would pay with card in the USA, you pay with a card in Spain as well. But there is a difference: in the USA people are familiar with credit cards – both because they have one (or many) and because they keep receiving offers to get more – but credit cards are basically unheard of in Europe. People on this side of the Atlantic have debit cards, which means no worries about paying this bill at the end of the month and no interests payment (but also no short time credit).

Another difference is that no shop, ever, will take your card far from you to pass on the machine (I am still surprised that happened almost every time in restaurants in the USA!!!) In Europe they rarely touch your card. You take it from the bag and – pah! – they point their wireless card machine so that you can tap your card there (not pass; on most occasions, a tap is enough to read the chip). Sometimes you are requested to input your pin code, sometimes not; I think it depends on the amount – higher payments, higher security.

You pay and right away receive a message on your phone saying your card was used in that shop and the amount spent; the amount is deducted immediately. It is beautiful and makes tracking really easy. Maybe its my age, but I do think easy banking – or not having to think of bank at all, actually – adds to life quality as much as living by the sea. 😉

Next: To the airport!

| This page contains affiliate links. This means you’ll be helping keeping this site up if you click on the links or use the services they provide, at no extra cost to you. Check our Affiliate Disclaimer here. |

I found this post incredibly useful. The tips and insights you’ve shared are going to be very helpful for my work.